A recent study from the University of East Anglia’s Centre for Competition Policy, Loughborough University, and E.CA Economics suggests that taxing specific medications could aid in the fight against the growing issue of human antibiotic resistance. A major global threat, antibiotic resistance (AMR) is thought to be responsible for 700,000 fatalities a year. Before this, a significant AMR study cautioned that if left unchecked, the disease might threaten 10 million lives annually and cause $100 trillion in lost economic output by the year 2050.

The main cause of AMR is human usage of antibiotics, the bulk of which are given by GPs in the UK. Both narrow- and broad-spectrum medications reduce antimicrobial resistance (AMR) by targeting certain germs; however, narrow-spectrum medications necessitate identification of the pathogen.

AMR is exacerbated when broad-spectrum antibiotics are used more frequently when the pathogen is unknown.

In a 2016 report, the UK government advised testing for pathogens prior to prescribing and, when necessary, utilizing narrow-spectrum medications. Expensive or time-consuming testing can result in the overprescription of broad-spectrum antibiotics, which raises the risk of antibiotic resistance.

Economists looked studied the viability of “taxing” general practitioner practices (GP) for prescribing specific broad-spectrum medications. The concept is that the amount of the tax would be deducted from the prescription budget each time a doctor writes a prescription for the medication.

They contend in a paper published in the International Journal of Industrial Organization that general practitioners’ freedom to prescribe certain treatments may promote the use of narrow-spectrum medications while also attempting to cut down on the expense and duration of testing. Additionally, by modifying the relative costs of the medications, it might be able to control the demand for antibiotics.

Antibiotic resistance is an important issue and a priority for UK health policy. It’s possibly the next ticking time bomb in the healthcare system.

In our analysis, the financial burden of the tax is not on the patients but rather on the GP practices who may be overprescribing in some cases. Our findings show that switching from broad to narrow-spectrum is possible via changes in relative prices brought about via taxation, but it has implications – in terms of the total cost to society.

While the alternative tax regimes we consider differ in how much demand will shift, our estimates suggest that these policies can be highly effective in managing that demand.” – Co-author Prof Farasat Bokhari, previously of UEA’s School of Economics and now at Loughborough University

The researchers emphasize that such tax laws shouldn’t be put into effect if they don’t permit exemptions for certain diseases depending on severity, which the doctors could attest to. They also admit that the transition from wide to narrow-spectrum antibiotics may be slowed down if decisions must be made quickly and waiting for an accurate diagnostic test to determine which narrow-spectrum antibiotic to provide is not an option.

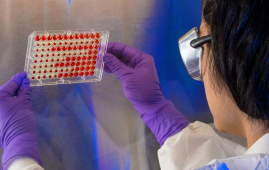

The study employs economic models to evaluate substitution patterns between different antibiotics as well as the effects of pricing, seasonality, spectrum, and other aspects of medicine on demand. It is based on ten years of monthly sales data for antibiotics prescribed in UK pharmacies.

It examined the effects of two different tax kinds on several medication categories. First, a percentage tax (5% or 20%) on all antibiotics, all broad-spectrum antibiotics, and some broad-spectrum antibiotics (co-amoxiclav, quinolones, and cephalosporins) that are known to be the main cause of antibiotic resistance. A set tax amount per medicine unit is the second.

12.7% less antibiotics are used overall when there is a 20% tariff on all antibiotics. But only by 29.4% does it lessen the usage of the most troublesome broad-spectrum antibiotics. The difference between what a person is prepared to pay and what they actually pay—the consumer welfare loss—caused by this tax is £322 per 1000 persons, or roughly £19.9 million annually in the UK.

However, because most patients switch to narrow-spectrum medications, the usage of broad-spectrum antibiotics decreases by 37.7% and the overall use of antibiotics declines by only 2.38% if the same 20% tax is solely applied to the pharmaceuticals that contribute the most to antibiotic resistance. A lesser consumer welfare loss of £78.2 per 1000 individuals, or £4.8 million annually, is the consequence of this more targeted tax.

“The consumer welfare loss and overall welfare loss from taxing these antibiotics are significant, but they are relatively small compared to the predicted societal costs of antibiotic resistance in terms of deaths and economic losses,” stated lead author Dr. Weijie Yan of E.CA Economics.

“While our simulations show how much demand is shifted from broad to narrow-spectrum, and at what cost, it does not calculate the long-term benefits of switching to drugs with a lower AMR footprint.

“It is also clear that the estimated loss in welfare is much smaller than previous estimates of worldwide costs, and so it may be well worth considering such remedies to shift demand to narrow-spectrum drugs.”

For more information: Antibacterial resistance and the cost of affecting demand: The case of UK antibiotics, International Journal of Industrial Organization, https://doi.org/10.1016/j.ijindorg.2024.103082

more recommended stories

CTNNB1 Syndrome Study Explores Beta-Catenin Defects

CTNNB1 Syndrome Study Explores Beta-Catenin DefectsKey Takeaways Researchers in Spain are.

Tuberculosis Breakthrough with Experimental Antibiotics

Tuberculosis Breakthrough with Experimental AntibioticsKey Takeaways Experimental antibiotics disrupt a.

National Healthy Longevity Trial Receives Federal Support

National Healthy Longevity Trial Receives Federal SupportKey Summary Up to $38 million.

Red Blood Cells Improve Glucose Tolerance Under Hypoxia

Red Blood Cells Improve Glucose Tolerance Under HypoxiaKey Takeaways for Clinicians Chronic hypoxia.

Nanoplastics in Brain Tissue and Neurological Risk

Nanoplastics in Brain Tissue and Neurological RiskKey Takeaways for HCPs Nanoplastics are.

AI Predicts Chronic GVHD Risk After Stem Cell Transplant

AI Predicts Chronic GVHD Risk After Stem Cell TransplantKey Takeaways A new AI-driven tool,.

Red Meat Consumption Linked to Higher Diabetes Odds

Red Meat Consumption Linked to Higher Diabetes OddsKey Takeaways Higher intake of total,.

Pediatric Crohn’s Disease Microbial Signature Identified

Pediatric Crohn’s Disease Microbial Signature IdentifiedKey Points at a Glance NYU.

Nanovaccine Design Boosts Immune Attack on HPV Tumors

Nanovaccine Design Boosts Immune Attack on HPV TumorsKey Highlights Reconfiguring peptide orientation significantly.

High-Fat Diets Cause Damage to Metabolic Health

High-Fat Diets Cause Damage to Metabolic HealthKey Points Takeaways High-fat and ketogenic.

Leave a Comment